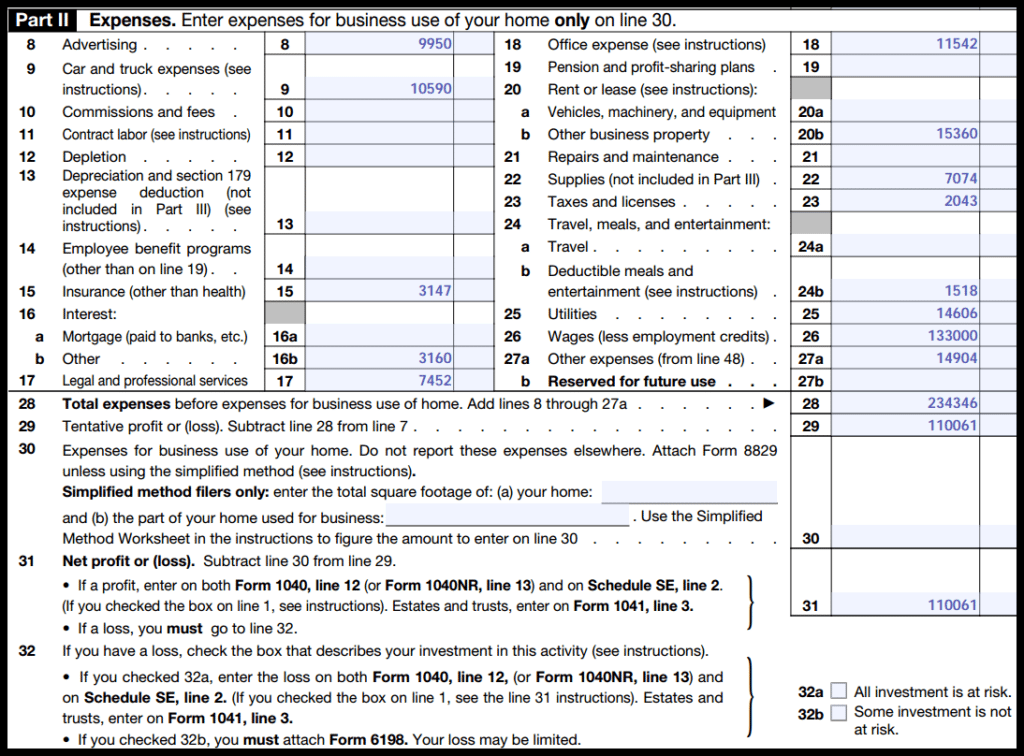

Schedule C Tax Form 2024. With 23 expense categories and 47 lines in total, it can be a daunting task to fill out, especially if you’re completing it for the first time in 2024, for your. This article is tax professional approved.

You fill out schedule c at tax time and attach it to or file it electronically with form 1040. Taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040).

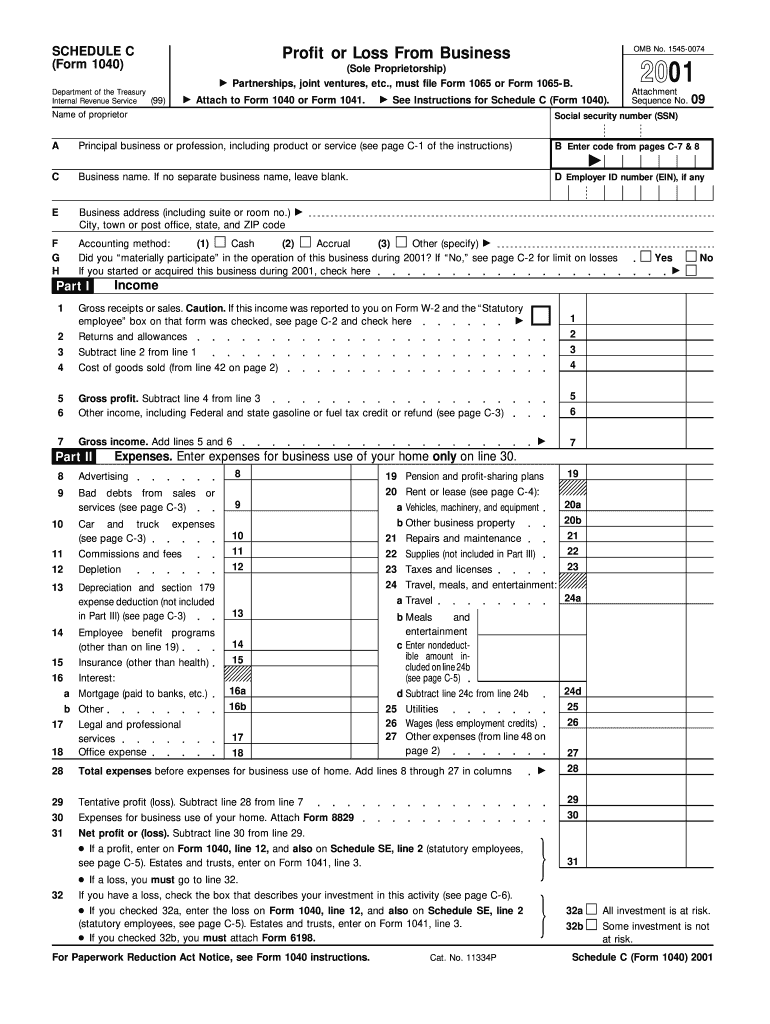

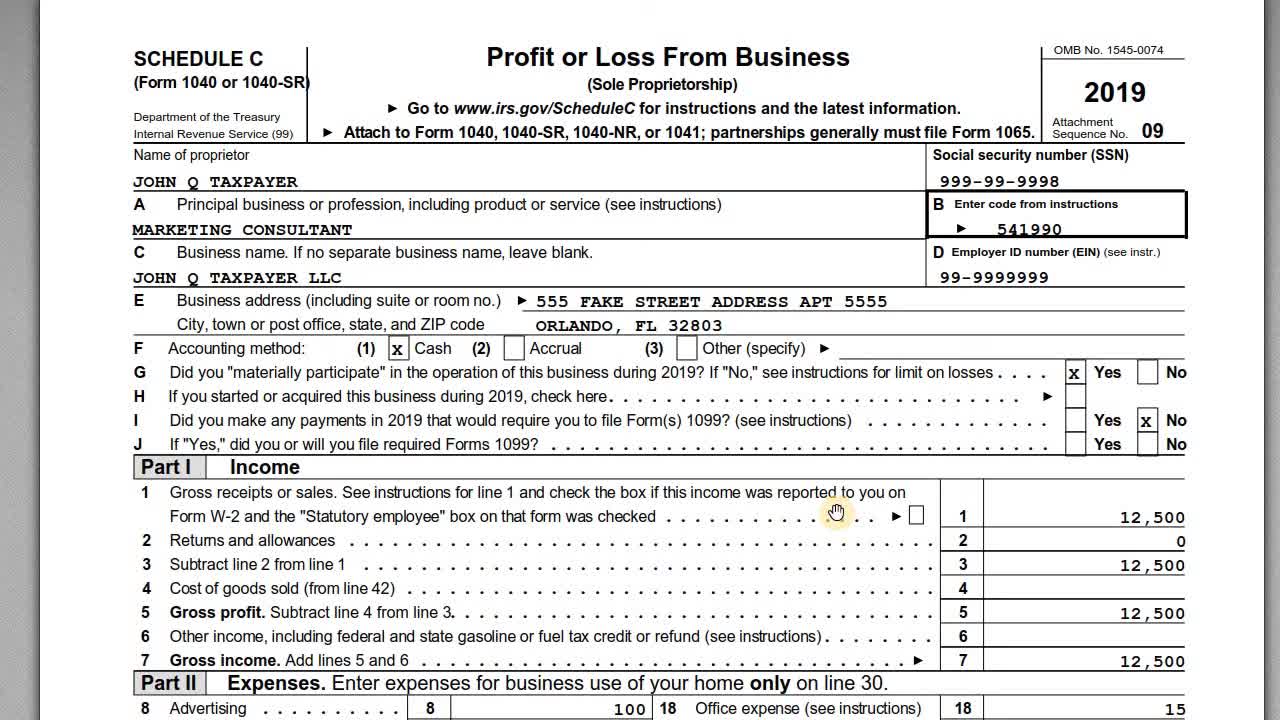

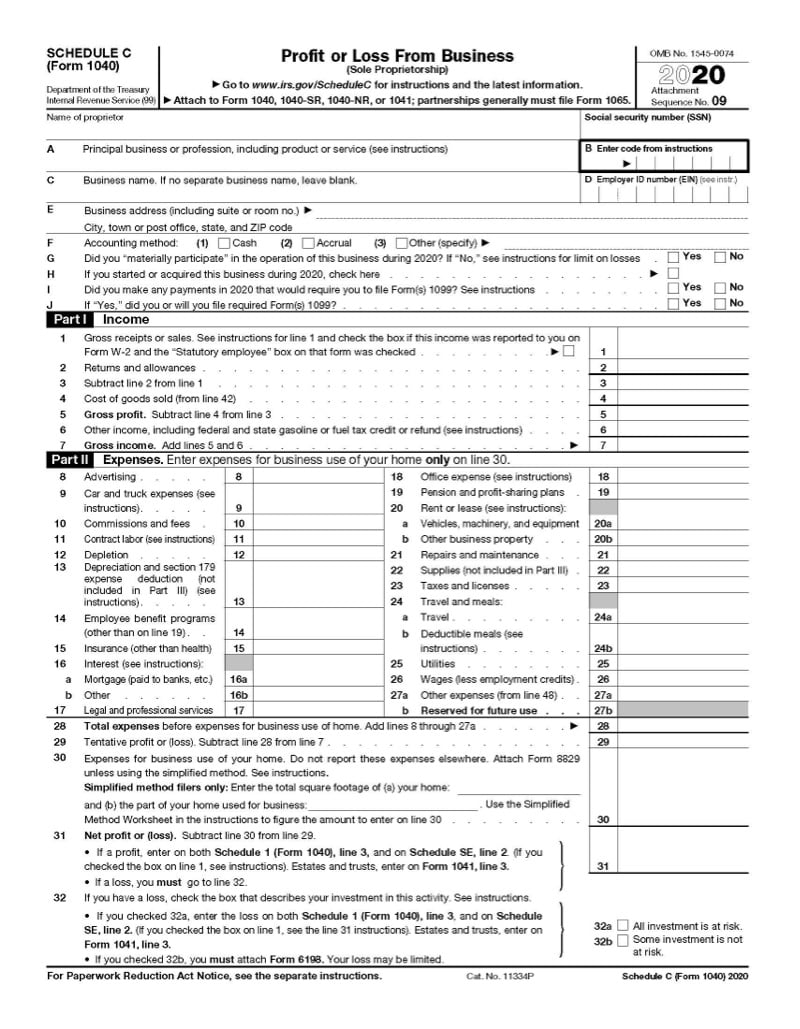

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession Practiced As A Sole Proprietor;

Get the latest information about tax season 2024.

Profit Or Loss From Business.

Page last reviewed or updated:

03 Export Or Print Immediately.

You can also follow the steps below to download the itr form xml file:

Images References :

Source: schedule-c-form.com

Source: schedule-c-form.com

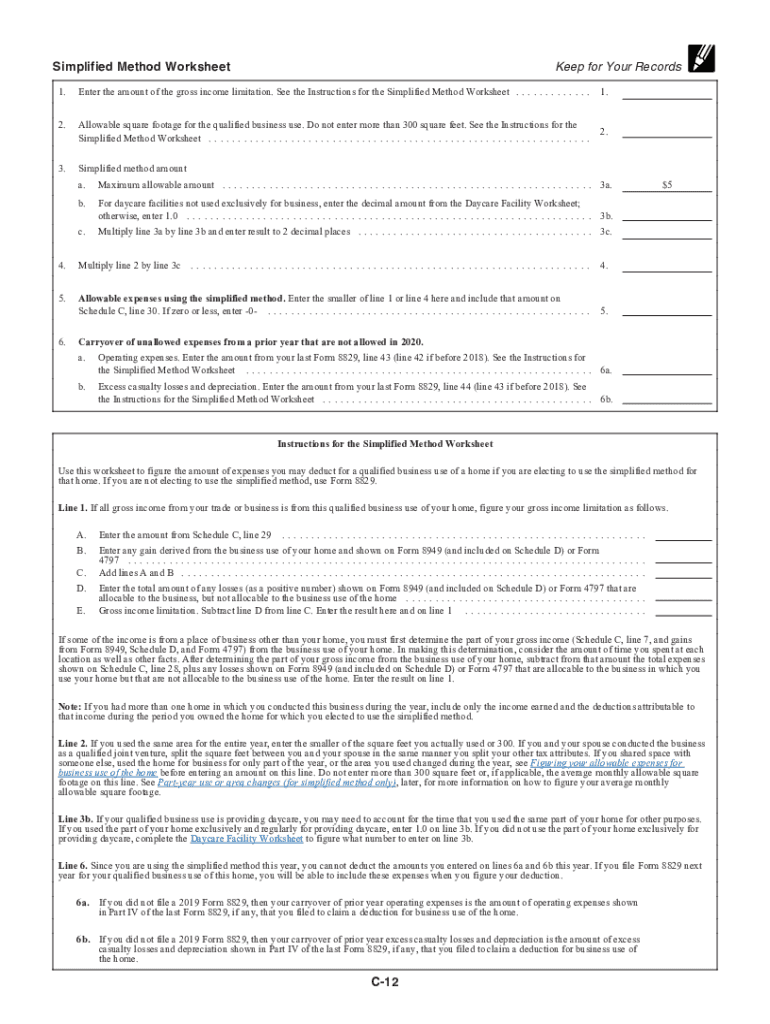

IRS 1040 Schedule C 2024 Form Printable Blank PDF Online, Schedule c is for business owners to report their income for tax purposes. You fill out schedule c at tax time and attach it to or file it electronically with form 1040.

Source: www.dochub.com

Source: www.dochub.com

Schedule c tax form Fill out & sign online DocHub, Where to find irs 1040 forms. Profit or loss from business as a stand alone tax form calculator to quickly.

Source: www.dochub.com

Source: www.dochub.com

Schedule c Fill out & sign online DocHub, Profit or loss from business as a stand alone tax form calculator to quickly. Profit or loss from business.

Schedule C Instructions How to Fill Out Form 1040 Excel Capital, What is a schedule c (form 1040). You can use this schedule instead of schedule c for a variety of reasons.3 min read updated.

Source: ca-ra.org

Source: ca-ra.org

A Friendly Guide to Schedule C Tax Forms (U.S.) FreshBooks Blog, What to expect when filing taxes this year an official website of the state. How to complete & file schedule c with your tax return;

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable Schedule C, November 27, 2023, 16:19 gmt. Irs schedule c is a tax form for reporting profit or loss from a business.

Source: rumble.com

Source: rumble.com

IRS Schedule C with Form 1040 Self Employment Taxes, Taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040). Civil services (preliminary) examination, 2024;

Source: www.jacksonhewitt.com

Source: www.jacksonhewitt.com

IRS Schedule C What is it?, Schedule c form 2024 for 2024. The directorate of government examinations, chennai, has published the exam schedule for the june 2024 diploma in elementary education.

Source: 1044form.com

Source: 1044form.com

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form, 03 export or print immediately. Taxpayers can deduct charitable contributions by itemizing their deductions using schedule a (form 1040).

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

What Is Schedule C of Form 1040?, Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Page last reviewed or updated:

Includes A Completely Free Option For Simple Tax Situations.

Irs schedule c is a tax form for reporting profit or loss from a business.

These Entities Report Business Income And Expenses On Schedule C, Which Is Filed With The Personal.

The directorate of government examinations, chennai, has published the exam schedule for the june 2024 diploma in elementary education.

Profit Or Loss From Business As A Stand Alone Tax Form Calculator To Quickly.

Schedule c form 2024 for 2024.